Inside this issue:

What's New: SAL Windows Update

National Student Loan Clearinghouse (NSLC)

Amendment to Bankruptcy Law

General Information: ECSI 1999 Conference

Close Out Dates

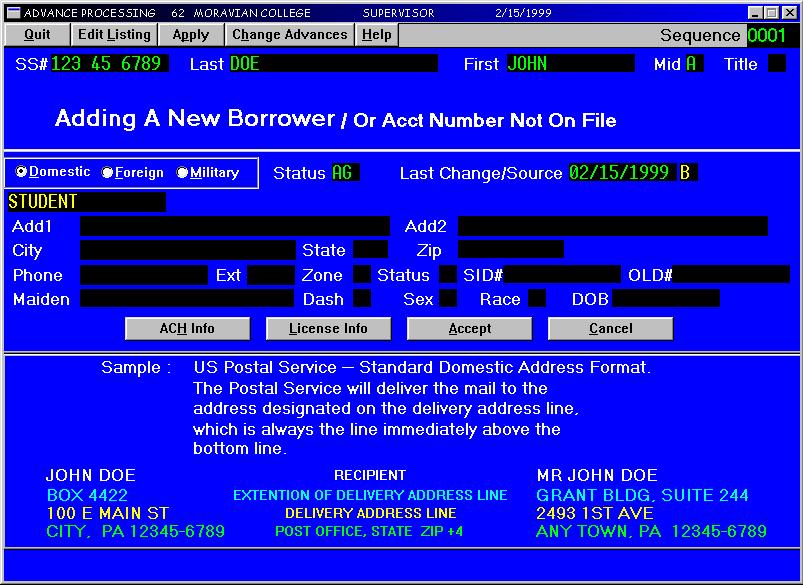

Access to the Advance window is provided when you click on the ADV button, or by selecting Advances from the General Functions Menu, located on the Primary Window. Once the Advance Processing window has been loaded, you have the ability to do any of the following:

The first step to entering a new disbursement is to enter the student's account number. Sal will notify you if it already exists on the file, or if this is a new account. Unlike the DOS version, Sal now requires you to enter in the fund information, amounts and necessary dates as the first step. If you are unsure of the name of the Fund Type you wish to disburse, right click in the Fund Type field and select Fund Types from the menu. A window will be displayed listing all of the types on file, their descriptions and the effective dates for the Fund Type. Double click on the type you desire, or enter the name in the Fund Type field. Finally, enter the remaining disbursement information as you would in the DOS system. After all of this information has been entered, click on the Accept button. (If you do not wish to post an advance to the account, press the Cancel button; all information will be removed from the window).

Once the above information has been accepted, Sal will display the Student Address for you to enter or change the student's demographic information. An example of a correctly formatted address will be displayed at the bottom of the window for use as a reference. Use this as a guideline for entering all addresses. The Address Information window also allows you to enter Driver's License and ACH information for the account at this time. To save the demographic information and proceed to the next step, press the Accept button.

After the student's demographic data has been accepted, Sal will ask if the student address is the billable address for the loan. If this address should be billed, or the billable address is unknown at the time of disbursement, answer Yes. If there is another billable address instead of the answer, select No. Upon answering no, a window will display asking for the billable address. Enter the new address and press Accept.

The last step to posting an advance is to enter Cosigner information. Sal will ask if there is a cosigner associated with the loan. If so, press Yes and enter the cosigner information when prompted. If a cosigner is not needed, answer No.

After all your advances have been entered, the same steps are followed as in the DOS product. Create an Edit Listing, verify the information, and finally, apply the advances. Sal now supplies you with the ability to look at the reports before printing them.

If an error was detected while reviewing the edit listing, click on the Change Advances button. A listing will show all advances not yet applied. Double click on the advance you wish to modify and Sal will automatically load that sequence into the advance window. Follow the normal posting steps explained above to correct the erroneous information.

Beginning Jan 1, 1999, ECSI started to utilize the services of the National Student Loan Clearinghouse (NSLC) for deferment processing. The interface between ECSI and NSLC works as follows:

ECSI sends a file of all borrowers in grace and repayment to NSLC. NSLC then compares their database (which consists of 80% of all schools in the U.S.) against the ECSI database, anyone registered at another school will be added to an interface file which will be transmitted back to ECSI. ECSI then creates a letter, stating where the student is now attending, what their current status is (full-time, half-time, leave of absence), when they are expected to graduate and reminds them they are eligible for a deferment if they sign and return this letter to ECSI. We will also create a collection memo stating which school they attend and their status and expected graduation date. Any borrower that withdraws from school or falls below "half-time status" will be corrected by ECSI Account Representatives. ECSI will also create and provide each school with a report, in detail, showing who was effected by this interface. This service is being provided free of charge. ECSI predicts that this new interface will greatly reduce both delinquency and late filing of deferment forms.

This is the second in a three-part series. In the first installment, we discussed the major parts of our Web site. We introduced you to the structure and gave an overview of the types of content. Most of our last issue was devoted to 'read-only' materials: those pages and articles we write and you read.

This installment will show our student account information service. This service extends our web site into an information retrieval tool.

Part 2:

How may I help you?

If you spent a day here with ECSI's Customer Service staff, you would hear that hundreds of times. There is always an endless stream of students wanting to gather some information about their last payment, outstanding balance, interest and the list goes on. We're only too glad to help them -- that is our job.

Unfortunately, we aren't open around the clock every day of the year. Some students have to make an effort to reach us due to their work, school or social schedules. We wanted to provide 24 hours a day, 7 days a week customer service without having to charge.

Enter the Web site. With a little work, we developed a system to allow borrowers to access their current account information using the Internet. Now, the borrower can check their information when it is convenient for them. The Web never gets tired, doesn't need breaks and can answer a nearly endless stream of requests almost instantly. Best of all, it is available around the clock.

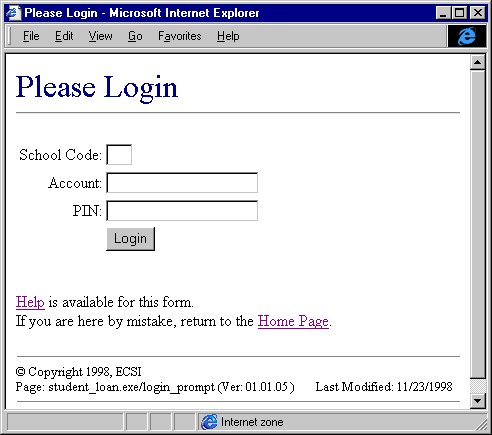

Starting in the fall of 1998, we began printing Web instructions on bills and coupons. We assigned each borrower a 'secret' PIN (Personal Identification Number). Using the school code, their account number and the PIN makes a unique combination to identify each borrower. The nice thing about the PIN is that it is not commonly known like a student's phone number or a zip code. Other people have tried to use such demographic information but it just isn't secure. We wanted something a step above the rest.

Armed with their three access codes, a student must login or 'identify' themselves. The first pictures is the login page that each student must complete.

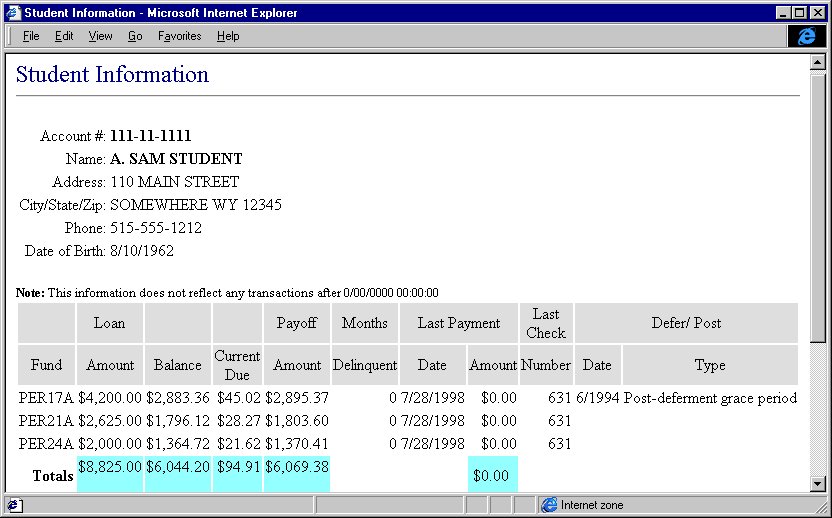

When we have ensured that everything is correct, the student is presented with a wealth of detail about their current account status. The second picture shows the results of a successful login. First we give them the ability to confirm their demographic information. Hopefully if they have changed their address or phone number, this will remind them to inform the school or ECSI. The line marked Note informs the borrower of the last update to the information. As in the example below, you can information about each loan, showing total amount, balance, current due, payoff amount, months delinquent, last payment date, amount and check number and any deferment or postponement. As a convenience, the dollars are totaled.

Currently there are over 1500 students taking advantage of this service. On average, each student has visited the site three times. That tells us that they found enough value in the information to keep coming back. Our intention is to keep adding value to ensure this service is successful for many years to come.

Last issue I promised some insight into the future. I'd like to share some of the changes that are on the table for the student access area. First and foremost we will be adding additional security to the student information pages. Before the end of March, we will begin using a feature of modern browsers called Secure Socket Layer (SSL). This provides the student with peace of mind that no one on the Internet can monitor their login or account information report.

Once SSL is in place, we can expand our offerings to include tax information such as the recent 1098-E. We will provide the borrower the ability to submit address and phone number changes on-line and in real-time. Another feature is providing the borrower the ability to fill-out a form which can produce the deferment/ postponement/ cancellation document for them to sign and submit, eliminating the delay in returning forms with incorrect or incomplete information.

Last, we will offer an interface for schools to view the information contained on the web page without sacrificing the security of PIN numbers. This will let you view the same information that a borrower may be referencing. We will be holding more detailed discussions about the Web and ECSI's other Internet services at this year's conference. You will find information about our conference elsewhere in this issue.

The Higher Education Amendments of 1998 (P.L. 105-244) include a significant change to the Bankruptcy Code (Section 523(a)(8) of title 11, United States Code), which repeals the seven-year exception for educational debts. For your convenience, we have reprinted below the text of Section 523(a)(8), showing the amended language. The bold text has been added and the underlined text has been deleted.

"The discharge under section 727, 1141, 1328(a), 1228(b) or 1328(b) of this title does not discharge an individual debtor from any debt for an educational benefit overpayment or loan made, insured or guaranteed by a government unit, or made under any program funded in whole or in part by a governmental unit or non profit institution, or for an obligation to repay funds received as an educational benefit, scholarship or stipend, unless excepting such debt

(A) such loan, benefit, scholarship, or stipend overpayment first became due more than 7 years (exclusive of any applicable suspension of the repayment period) before the date of the filing of the petition; or

(B) excepting such debut from discharge under this paragraph will impose an undue hardship on the debtor and the debtor's dependents."

This amendment applies only to cases filed under title 11, United States Code, after October 7, 1998, the date of enactment of the Act. As a result, student loans or other educational debts, as described in the excerpt of the statute printed above, are no longer dischargeable.

Regs-law/Bankruptcy law - Amendments of 1998

We hope you will be able to join us at our User's Conference this year. Mark your calendar for April 12th through the 14th. We have an incredible lineup for this year. In fact, there are so many things this year that it would be hard to list them in just one article.

So, we're doing the next best thing. You can find the full conference literature in the same package as this newsletter. We have also posted the details on our web site (see Clients page). We have included a detailed itinerary and a description of each session.

In past years, Wednesday was considered an optional day and many people left early on Tuesday. This year we encourage you to review the schedule and consider staying for all three days.

As always, Monday is overflowing with information. Tuesday is full of good topics through the late afternoon. Wednesday's session on our new Windows product has been extended for the entire day so that we can address many more of the issues requested since last year. If you don't want to spend all day on Windows, come join one of our other sessions on Wednesday. Honest, there is something here for everyone.

Come and enjoy a lot of learning and the chance to share information and ideas with your peers and ECSI. We hope to see you at the 1999 User's Conference!

| March | April | May | |

| Mid-month Billing Calc | 12 | 13 | 13 |

| End-month Billing Calc | 30 | 29 | 31 |

| Final Transmission date for reports | 31 | 30 | 31 |

| Reports mailed to schools | 4/2 | 5/2 | 6/2 |