Automatic Collection Agency Placement

ECSI has added a new feature to our system, the automated collection agency placement module. This module should greatly enhance the process of assigning accounts to your collection agencies.

The following parameters are needed to initiate the process:

- The month delinquency tag at which the accounts will be turned over to the agency

- Select all agencies that will be participating

- Two ways to assign accounts to the agencies:

- Evenly dividing the number of borrowers by the number of agencies participating

- Alpha split within the agencies

- Choose how many months, of no activity, for warnings of 1st, 2nd and 3rd

- Each level of placement will have the next higher level of placement within an agency or government review status

Every month, the schools will be e-mailed 4 reports:

- A listing of each borrower assigned, this month, to each collection agency.

- A listing of each borrower who will be assigned, next month, to each collection agency.

- A listing of each borrower assigned to an agency that meets the first, second or third no activity warning.

- A listing of each borrower assigned to an agency in that the agency has had the account for the maximum time held without any activity and will be recalled.

New agency placement report

The new agency placement report contains the following information:

- social security number

- name

- campus code

- fund type

- collector/agency code and name that the borrower was just assigned to

- debt balance

- monies now due

- months delinquency

- last payment amount

- last payment date

- cohort year

The cohort year tag is (T) for this year and (N) for next year’s cohort. The end of the report will summarize totals for the number of borrowers and the number of loans assigned to each agency and grand totals.

Potential agency placement report

The potential agency placement report contains all of the information that the new agency placement report has, plus 2 additional columns:

- Auto agency turnover stop code

- Rehab, rescheduled or renegotiated

Auto agency turnover stop code

To permanently stop an account from being assigned to a collection agency, check off the permanent auto agency turnover stop code check box. These borrowers will be displayed on the report with a “P” under the “Stop Auto” field. If there is any information in the agency stop code field (except for a “1”), the account will not be automatically assigned to a collection agency.

The borrower can also be delayed from automatically being assigned from 1 through 9 months by placing a number 1 to 9 in the temporary auto agency stop code field. Once a month when we run the automatic agency placement process the number will be reduced by 1 in the temporary auto agency stop field, if applicable. If you receive the potential agency placement report and there

is a “1” in the temporary auto agency stop field, and the number is not increased or changed to permanent within the next month, the borrower will then be assigned to a collection agency. Removing these auto agency stop codes, at anytime, will place these accounts back into the “pool” of potential accounts to turnover.

Rehab, rescheduled or renegotiated

If the account is under a current rehabilitation, rescheduled or renegotiated agreement, the borrower will not be automatically assigned to a collection agency. If any of these 3 options are met, a “Y” will be displayed under the “Rehab RN\RS” column.

The collector/agency code and name fields on the potential agency report will display the current in-house collector if applicable.

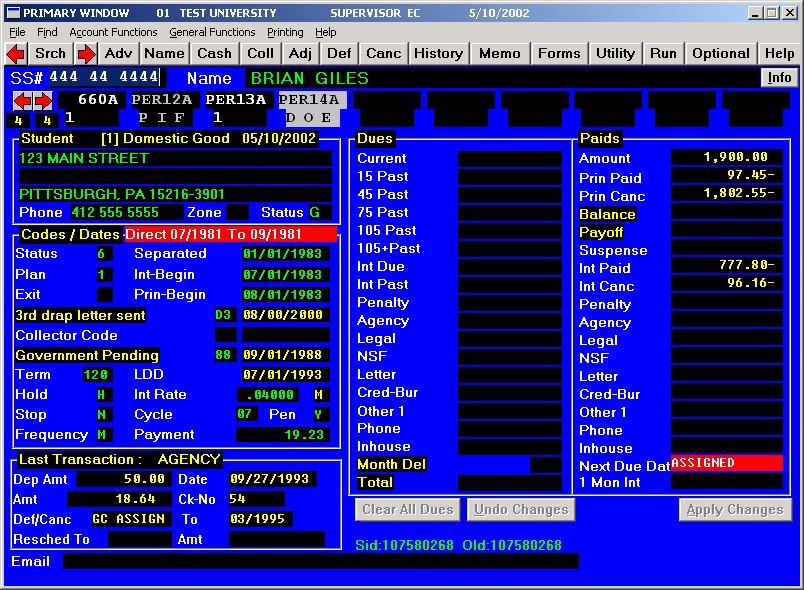

The following situations will prevent automatic placement with an agency:

- Months delinquency is less than the school’s chosen month to turnover

- In school, grace or paid in full status

- Valid auto agency stop code

- ACH

- Bankruptcy deferment

- Government pending status

- Rehab, rescheduled or renegotiated

- Made a payment within the last month

[Back to Top]

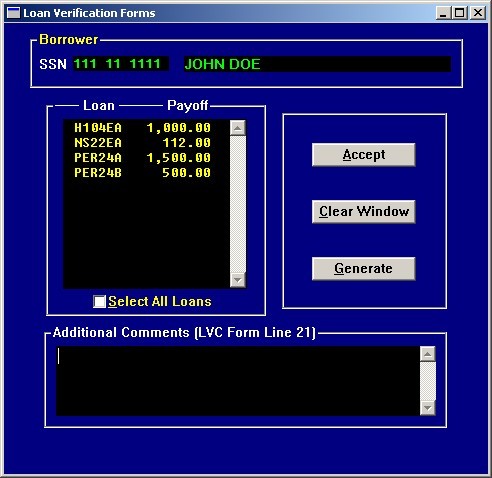

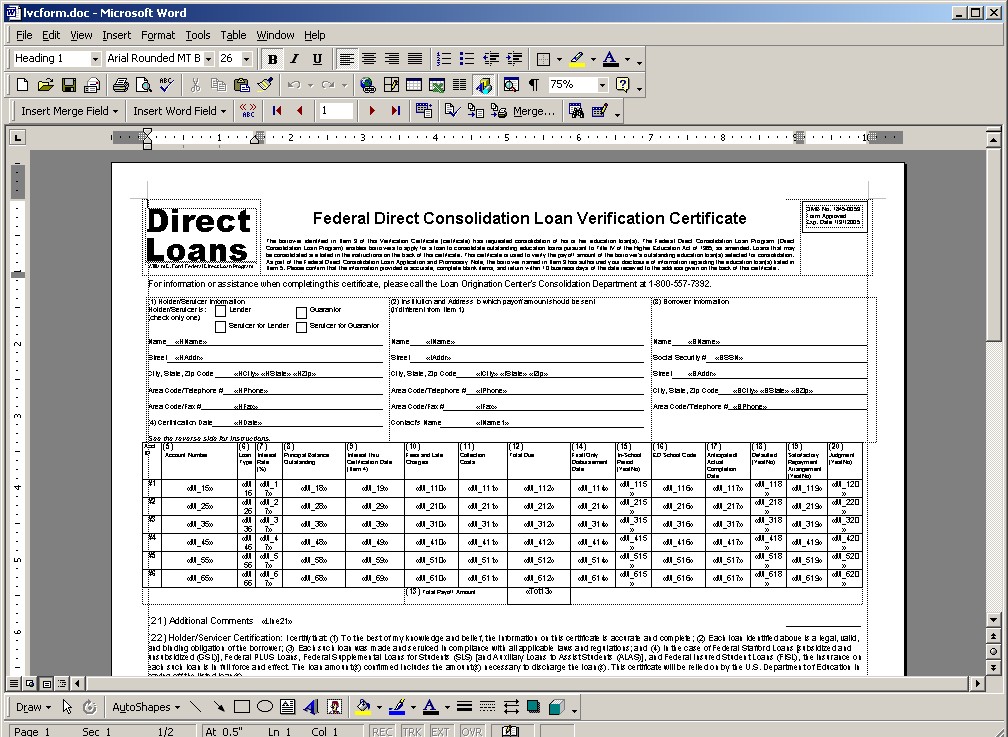

LVC Form Creation Direct Loans / Generic

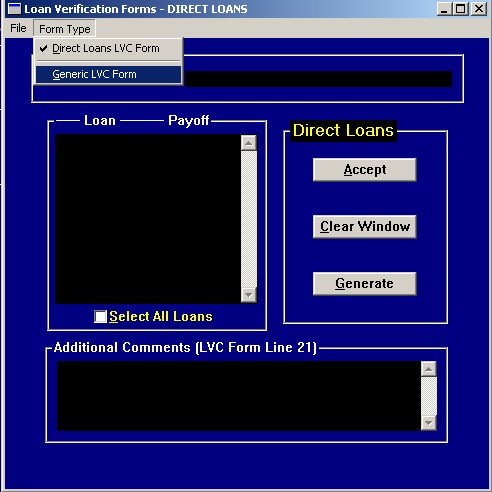

Direct Loans

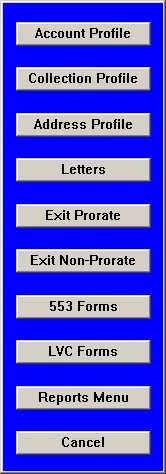

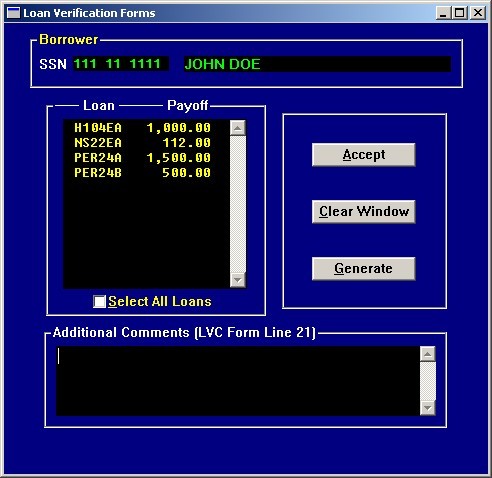

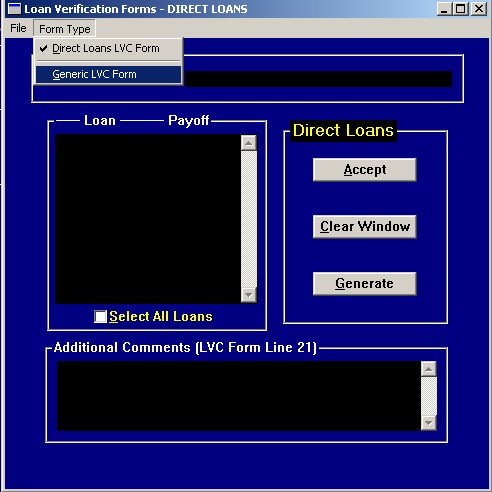

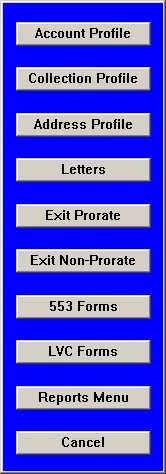

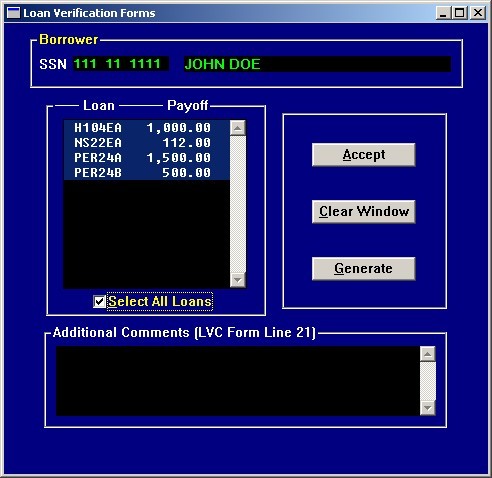

To produce an LVC Form for an account, click on the ‘LVC Forms’ button from either the Primary or Collection window of Sal.

The system will automatically load the account that is up on the Primary/Collection window for you, displaying each of the loans with an active balance.

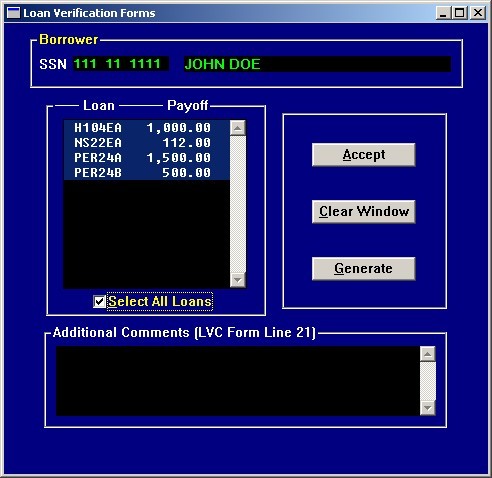

Next, select which loans to include on the LVC Form by single clicking on them, or if all loans are desired, click on the 'Select All Loans' check box.

If a comment is needed for Line 21 of the form, enter it in the box labeled 'Additional Comments' at the bottom of the window.

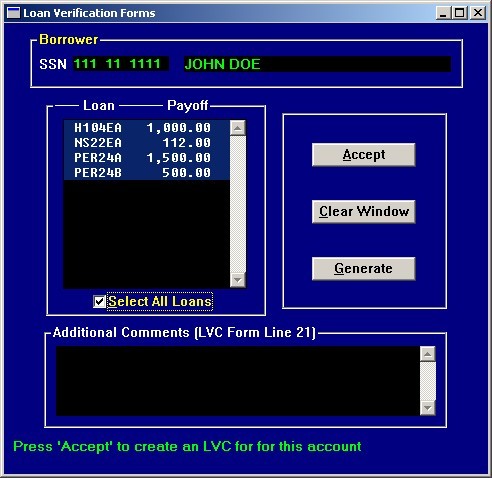

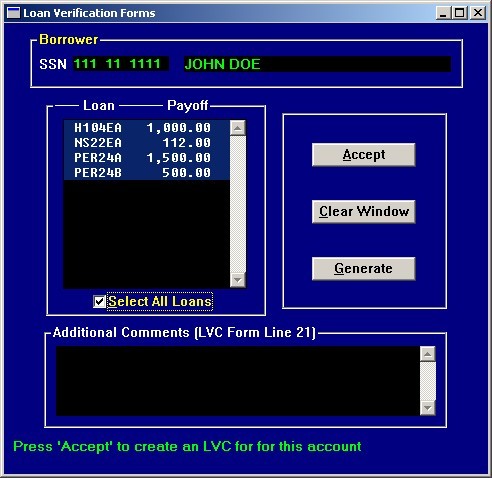

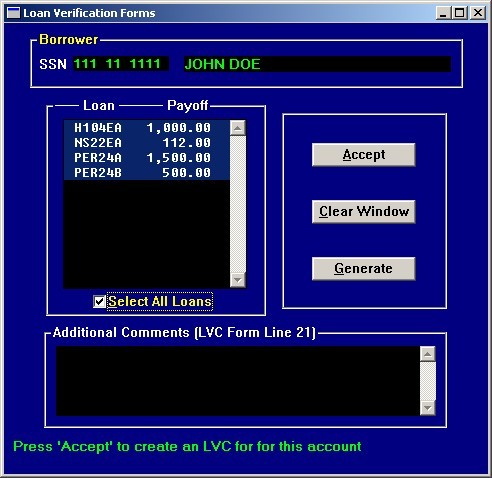

Next, click on the 'Accept' button to create the merge data necessary for Word to produce the form.

The cursor will now return to the SSN field to allow you to enter another account to create an LVC Form.

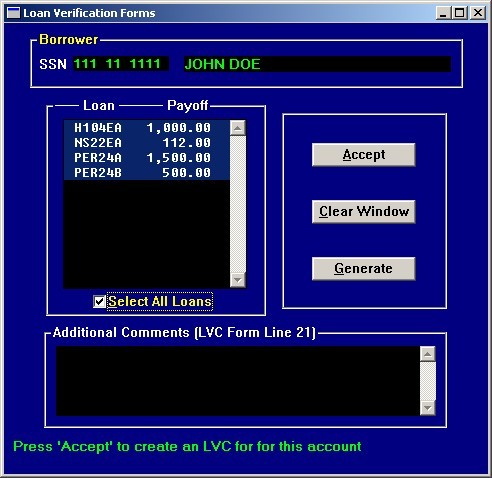

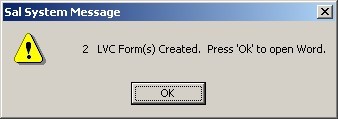

Once all accounts have been entered, click on the 'Generate' button to send the merged data to Word so that the form can be printed. A comment stating that an LVC form was generated will be cut for each account receiving the forms.

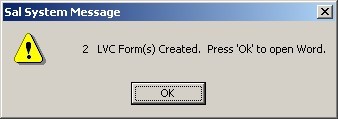

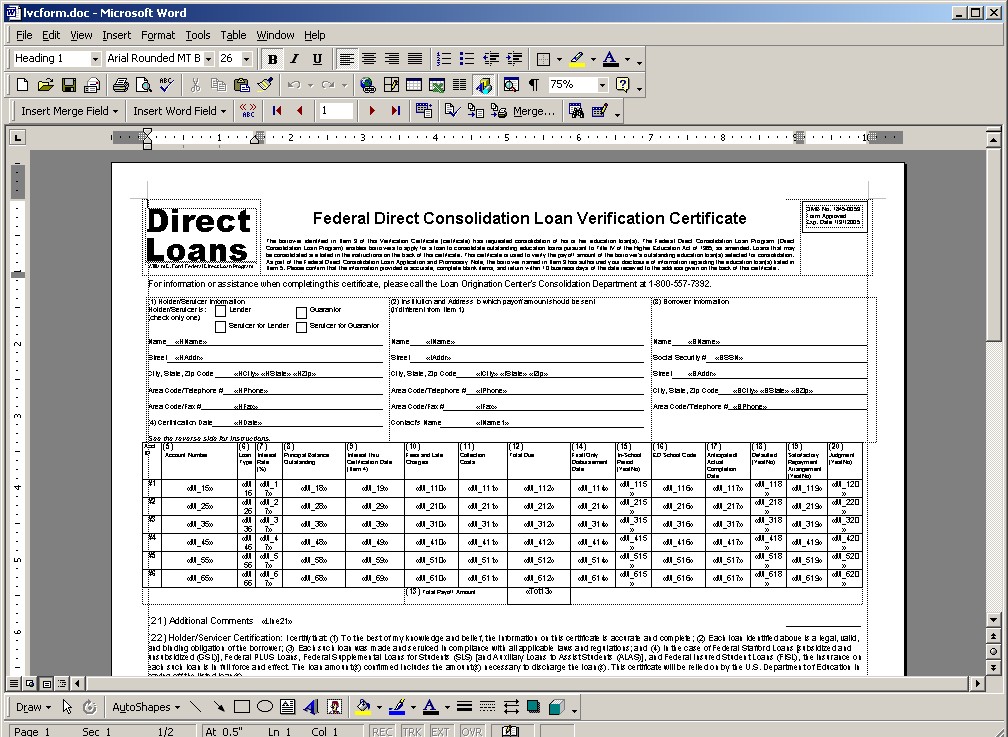

Once the form is ready to be merged and printed, you will receive a message stating how many forms were created. Once the 'OK' button is pressed, the LVC form will open for merging in Word.

To complete the merge, click on 'Merge to Printer' or 'Merge to New Document'.

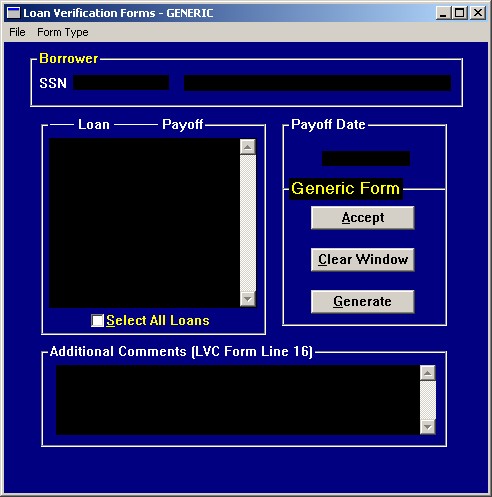

Generic Form

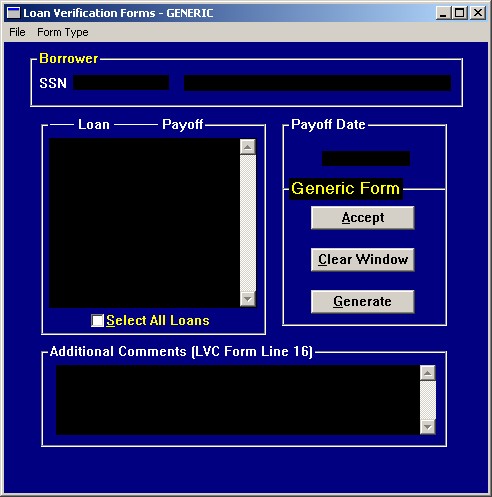

The LVC Form routines have been updated to include the option of printing a generic LVC form that can be used for several other consolidation companies.When the LVC window is displayed, it will default to the 'Direct Loan' format. If the generic format is desired, click on 'Form Type' from the menu bar and then 'Generic LVC Form'. (The window that is currently displayed will be designated by a checkmark next to the name).

The Generic window includes the Payoff Date field (defaults at 2 months in the future) enabling the amounts on the form to be forecasted. The generic form includes the ability to forecast using this date. Each window will also display the form name that is being processed on the window title bar and also above the 'Accept' button.

The rest of the steps to create the forms stay the same. The last change will be that when the forms are generated, the system will now open form that was created.

[Back to Top]

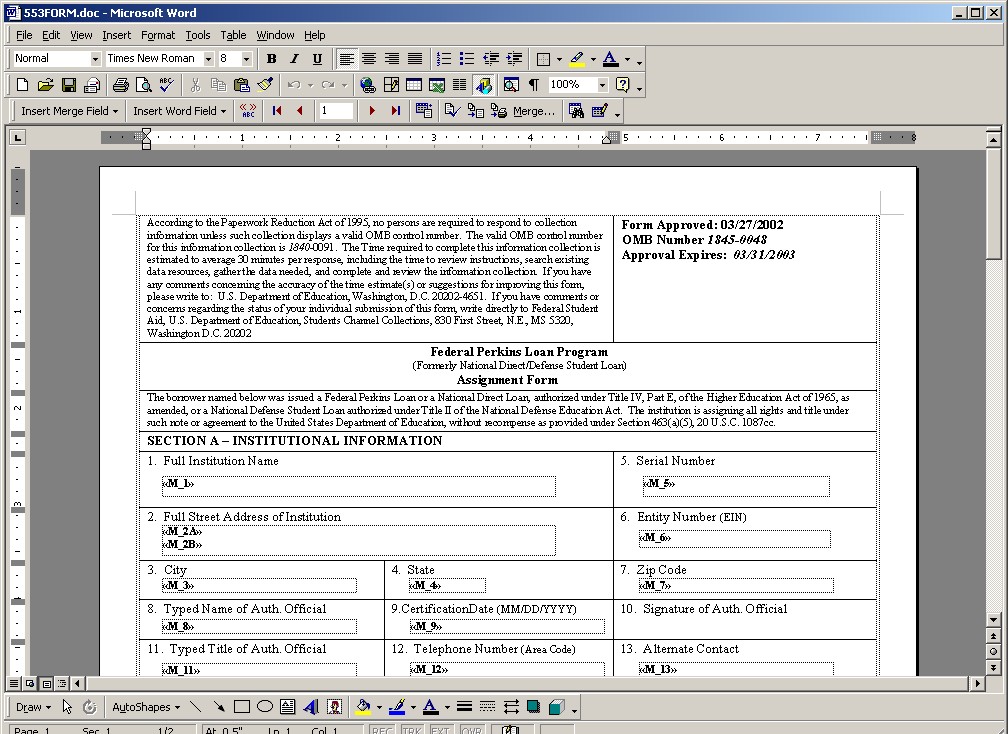

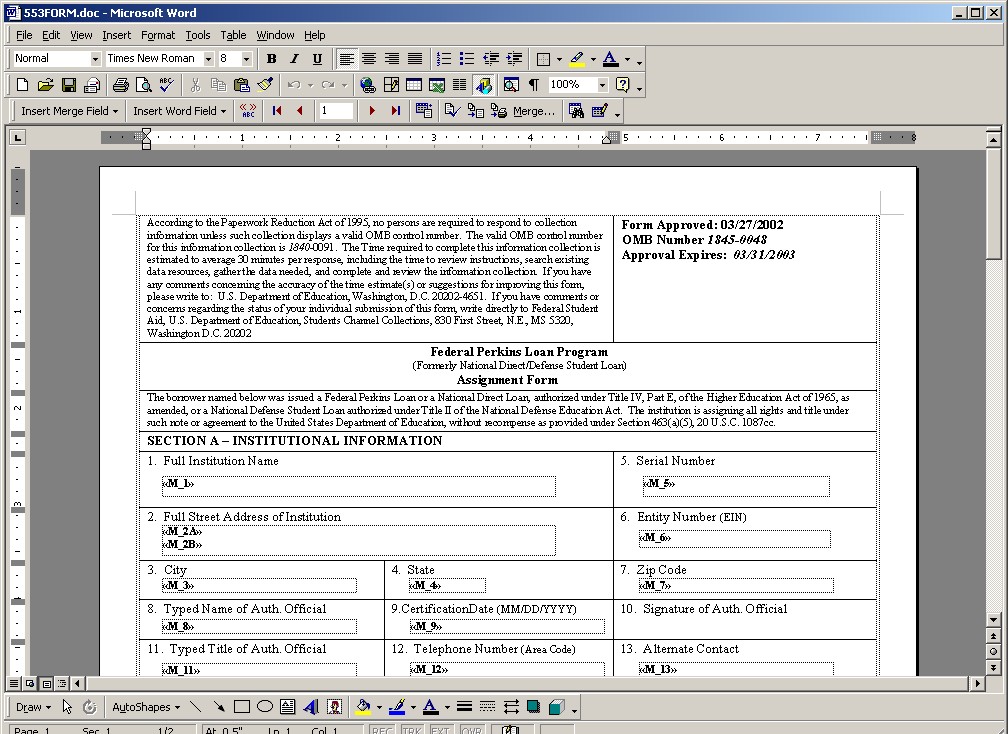

Changes to Report 553 Processing

The 553 form has now been converted to a Word based merge file. This allows us to move away from the pre-printed forms and also the requirement of the form being duplexed.

As a result of this change, the 553 processing has been slightly modified.

The main process is still run using the same steps:

- Enter an SSN

- Select the loans to assign

- Click on 'Accept'

- Enter the next SSN or click on 'Generate' to produce the forms

The main change is that after the 'Generate' button is pressed, a message will display notifying you that Sal will now open Word allowing the forms to be merged and printed

To complete the merge, click on 'Merge to Printer' or 'Merge to New Document'.

There is no longer a need to set the printer to duplex, or insert the pre-printed 553 form.

Word will produce the entire form automatically for you.

[Back to Top]

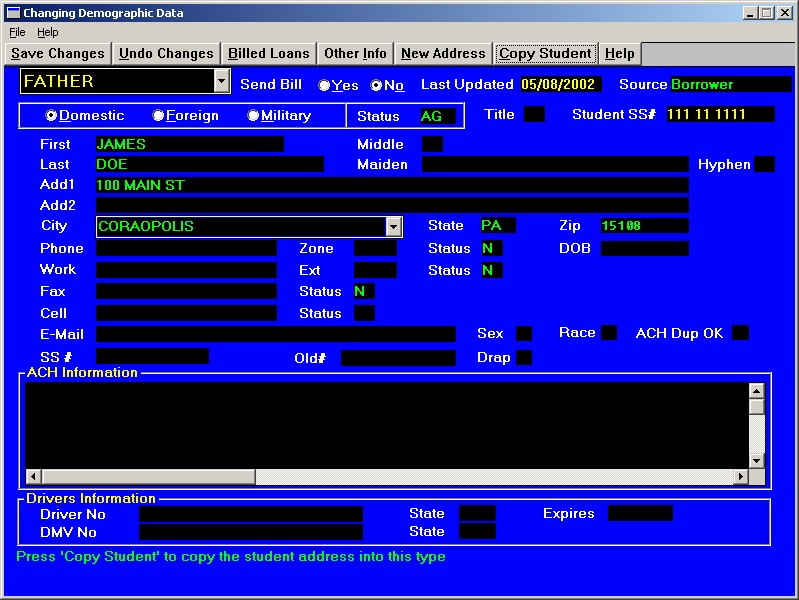

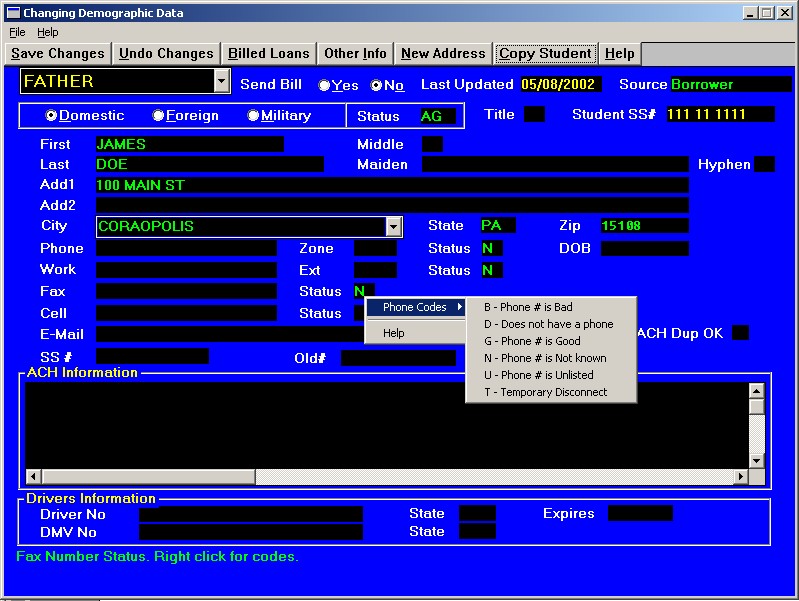

Enhancements to Name/Address

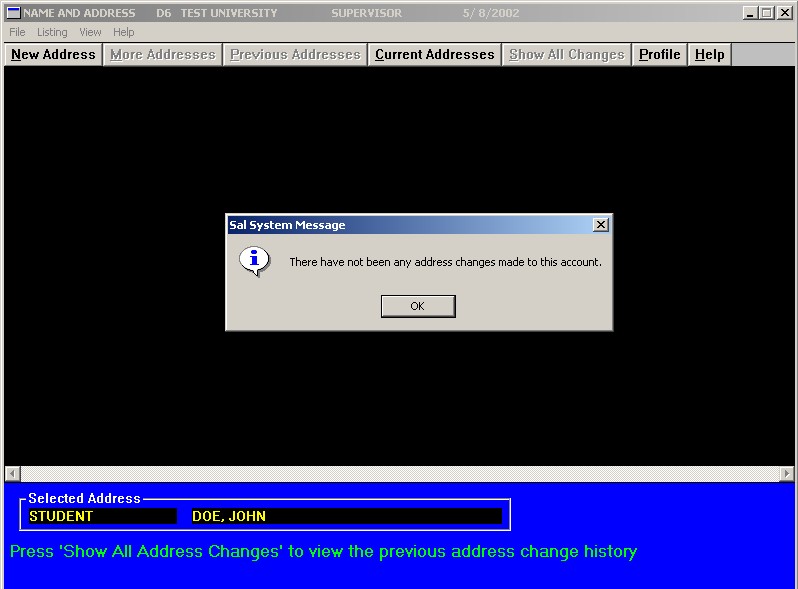

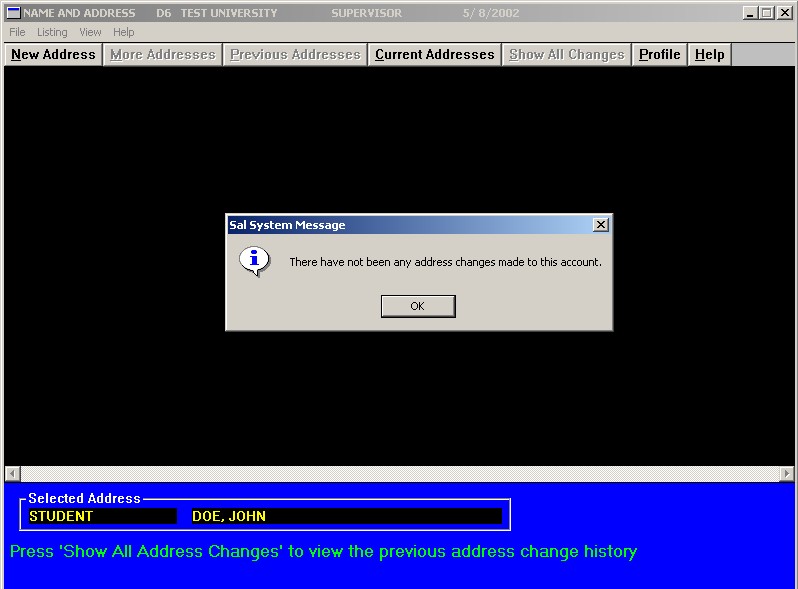

If no prior address changes exist and the 'Show All Changes' button is pressed, a message will pop up alerting you of the fact.

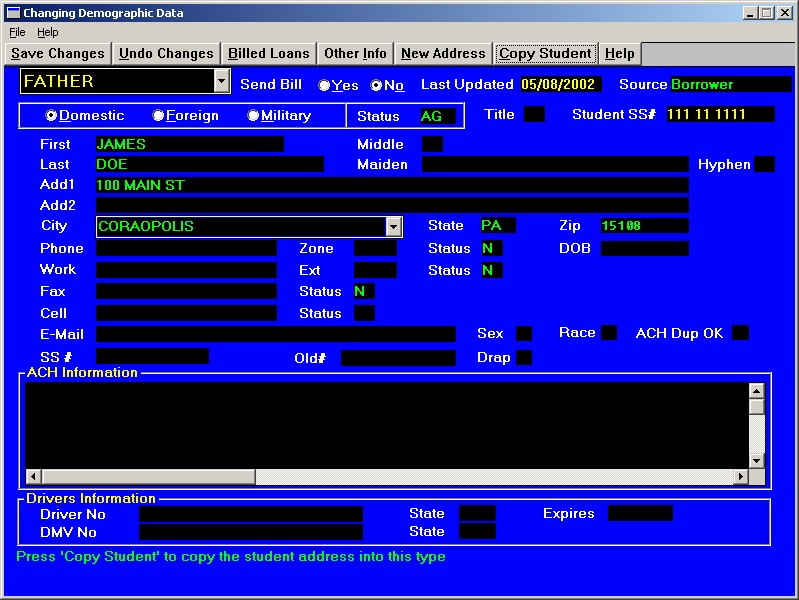

A 'Copy Student' button has been added that will copy in the student address/phone information, instead of having to retype it.

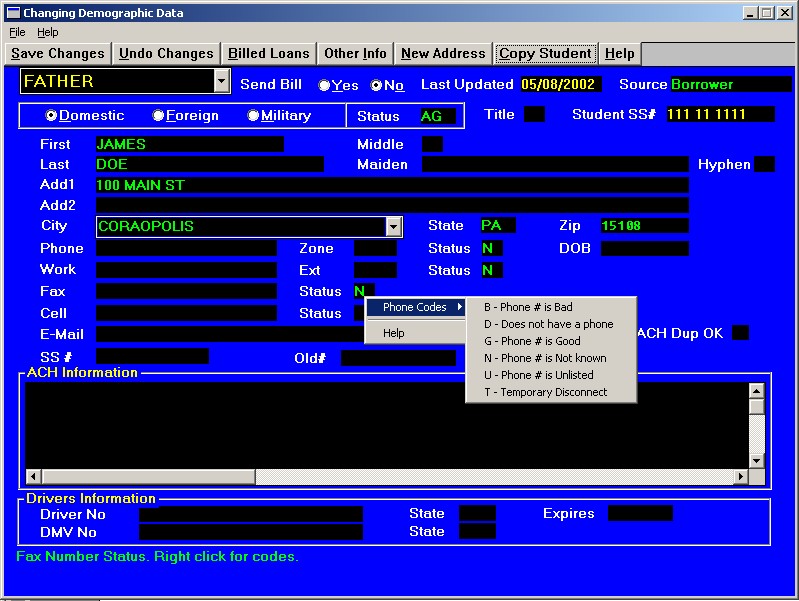

Status of 'Temporary Disconnect' has been added to list of eligible phone status codes.

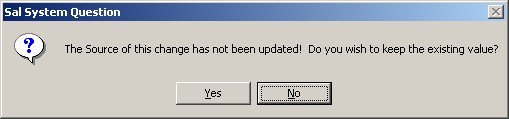

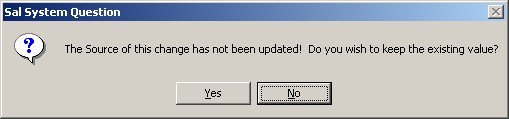

Added test if 'Source of Change' was not modified on an update to an address. If the user did not enter a new source for the change, this message will appear. If it is ok to keep the source the same, simply answer yes. This helps to more efficiently keep track of all name/address changes posted to Sal.

[Back to Top]

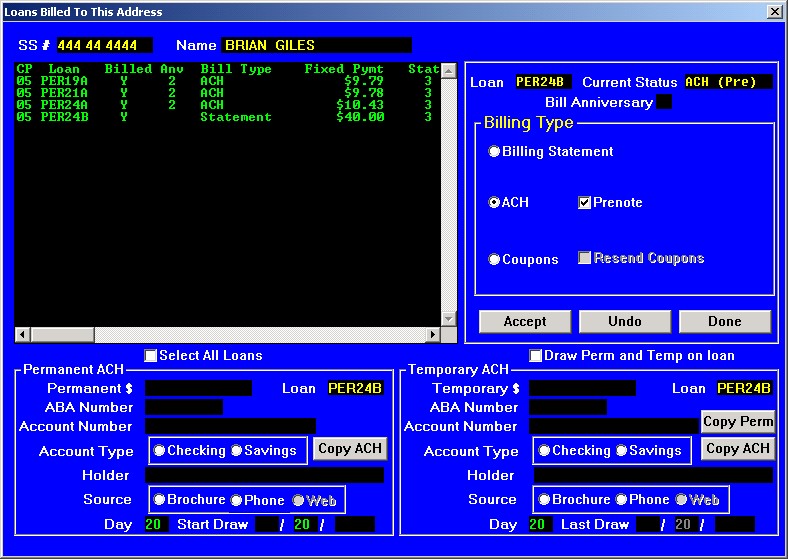

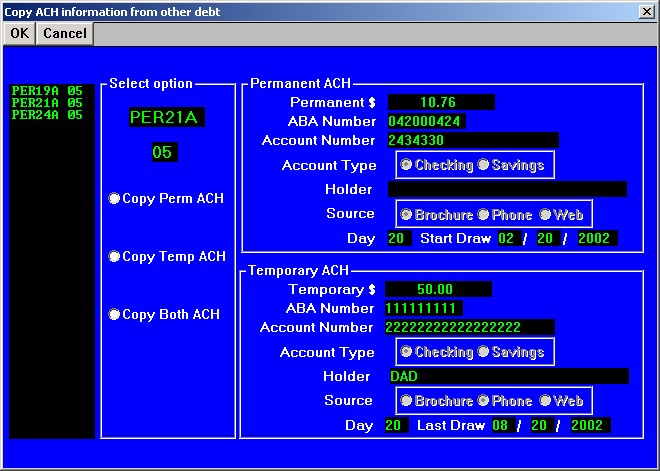

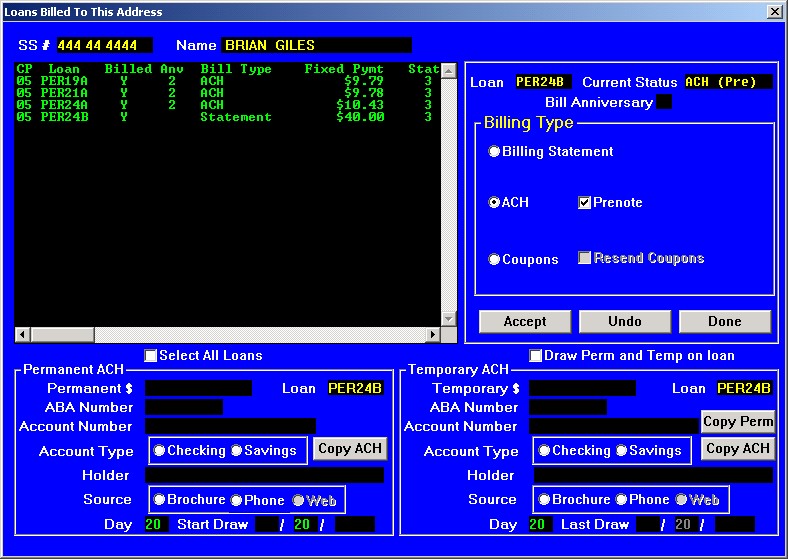

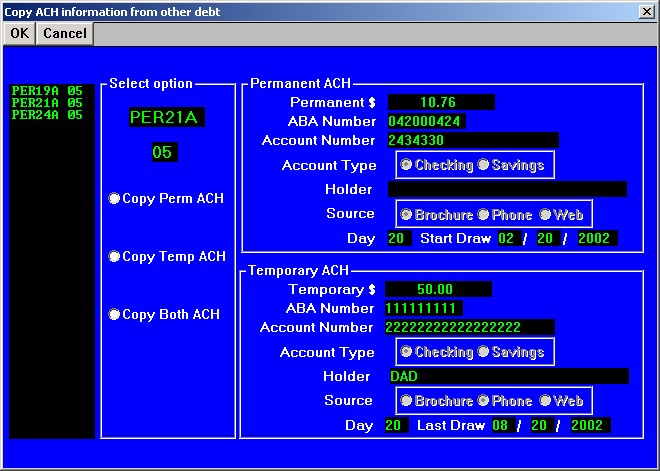

Copy ACH Information

A "Copy ACH" button has been added to the "Loans Billed to this Address" window. On the example below, the Perkins 19a, 21a and 24a debts are under ACH and the 24b debt is under a normal billing statement. The "Copy ACH" button allows the user to copy the ACH information from the Perkins 19a, 21a or 24a debts into the Perkins 24b debt instead of manually typing out all of the ACH information, there by reducing the chance of data entry errors.

When the "Copy ACH" button is clicked, the below window will be displayed. The list box on the left side of the window will list the available debts and their associated campus codes that have ACH information. By double clicking on 1 of the displayed debts, the Permanent and Temporary ACH information associated with the chosen debt will be displayed in the Permanent ACH and Temporary ACH areas on the right side of the window. The chosen debt and campus code will be displayed in the middle of the window in the "Select option" area. The user can then select the following 3 options:

- Copy Perm ACH - Copy the permanent ACH information from the chosen debt on the "Copy ACH information from other debt" window to the current debt selected on the "Loans Billed to this Address" window.

- Copy Temp ACH - Copy the temporary ACH information from the chosen debt on the "Copy ACH information from other debt" window to the current debt selected on the "Loans Billed to this Address" window

- Copy Both ACH - Copy the permanent and temporary ACH information from the chosen debt on the "Copy ACH information from other debt" window to the current debt selected on the "Loans Billed to this Address" window

Once an option has been chosen, the user can click on "OK" to complete the ACH copy process.

[Back to Top]

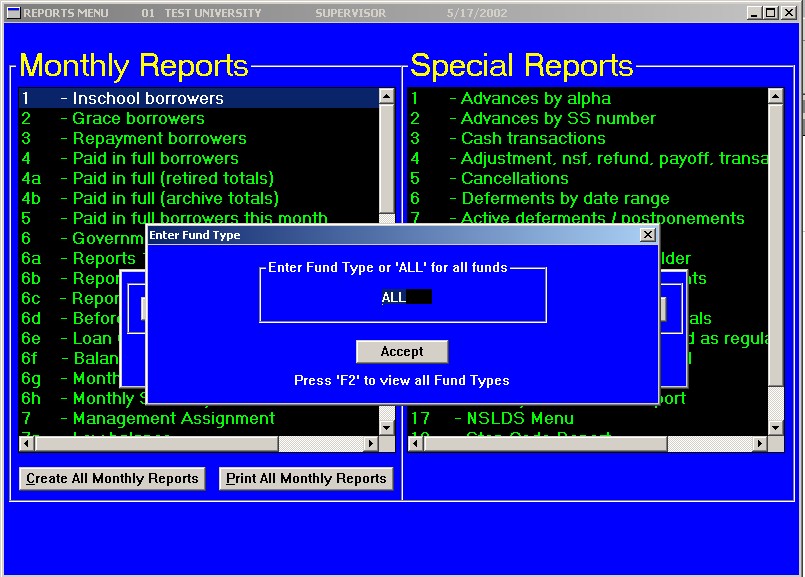

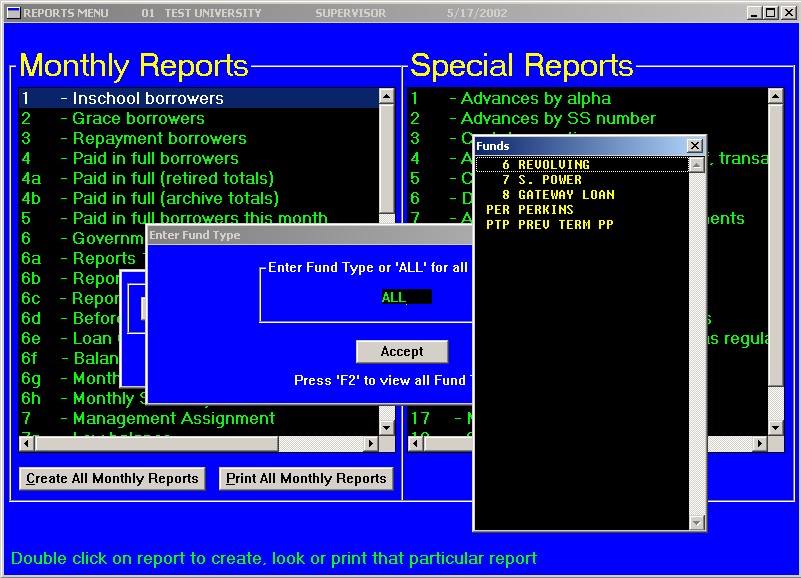

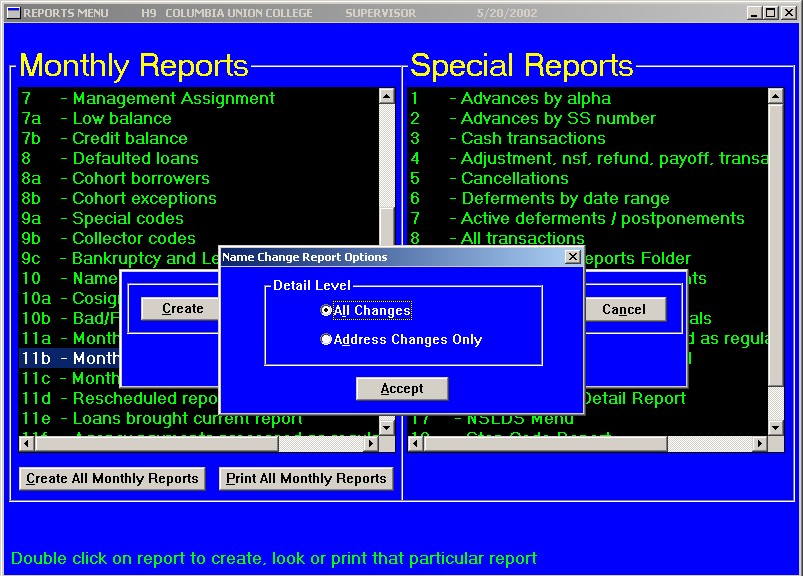

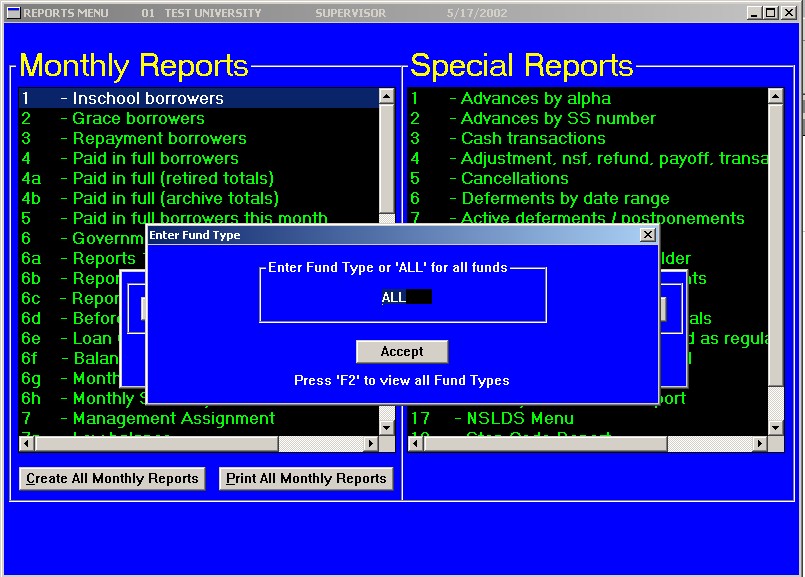

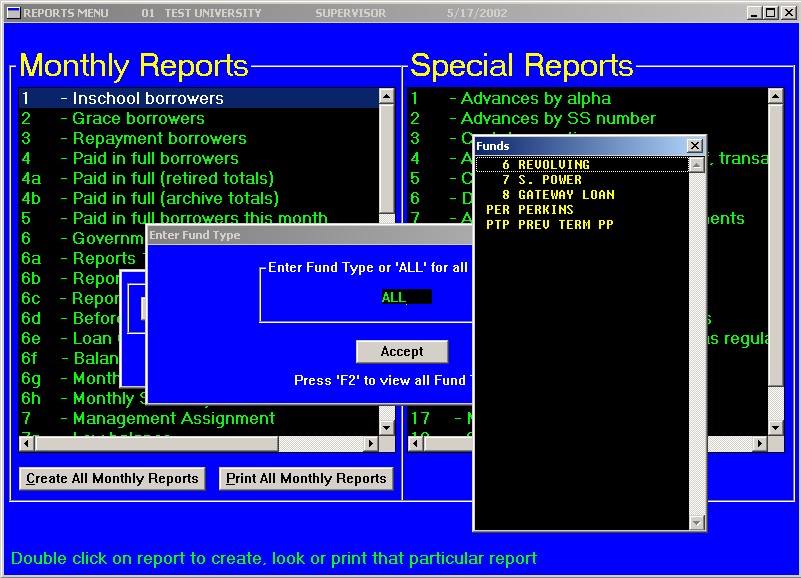

Running Reports 1 thru 10 by Fund Type

When you create report 1 thru 10 individually, you will now be prompted to enter a fund type.

You can either enter the fund type to create the report on, or leave it set as the default of 'ALL' fund types.

Pressing F2 will bring a listing of all fund types on file allowing you to select from the list.

When you "Create All Monthly Reports" button is clicked, the system will default to all loans without prompting for the fund type.

[Back to Top]

Document Writer Enhancements

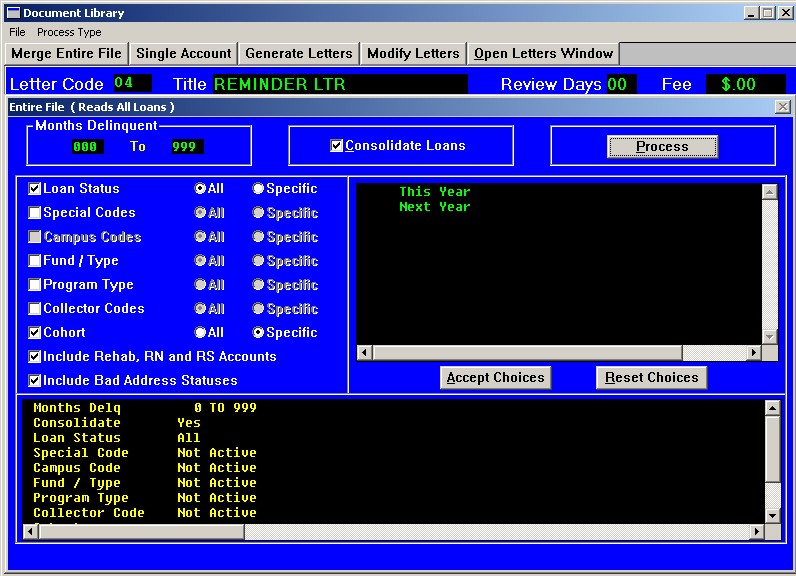

Mass Mailing Options

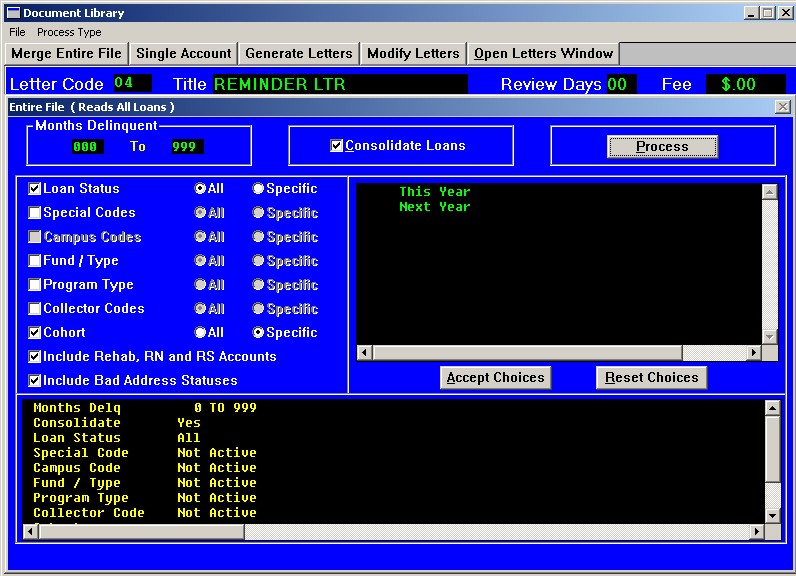

Three new search criteria have been added to the list of options when running letters on all loans (Mass Mailing). They are as follows:

- Cohort Accounts - Pick this option if you want the letter to go to only Perkins Cohort Accounts. You can leave the default selection of All to select both cohort years, or you can click on Specific and select which cohort year to send the letters on. When this option is set, only loans that are in Cohort will receive the letter.

- Include Rehab, RN and RS Accounts - By default, Sal has always bypassed accounts that are in Rehab, Renegotiation, or Reschedule when creating mass letters. This was due to the fact that almost all letters being generated are delinquent warning letters and you would not want them to go to borrowers that have made arrangements to bring their account current. By checking this option, each of these types of accounts will receive the letter regardless of whether or not they are Rehabed, Renegotiated, or Rescheduled.

- Include Bad Address Status - Sal has always bypassed any accounts with a bad address status in order to conserve postage. By setting this option, Sal will generate letters for any account regardless of its address status.

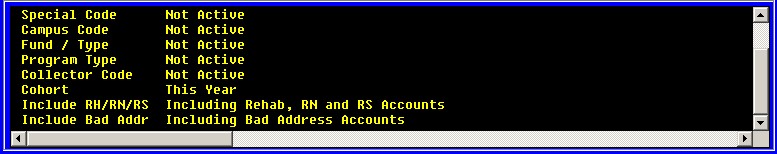

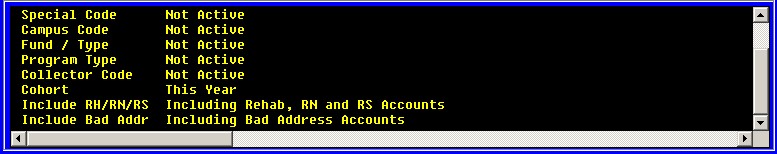

The Search Criteria display on the bottom of the window has also been update to display these new choices. Scrolling down the box will display the options selected by the user.

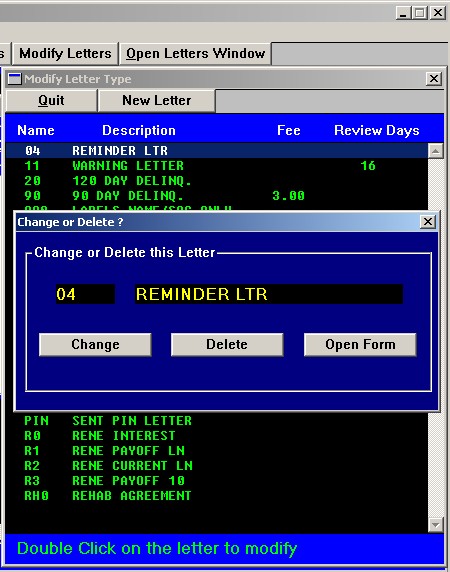

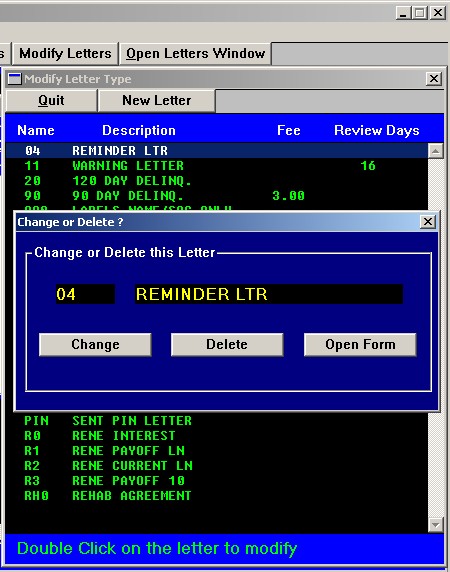

Modify Letters Window

When changing a letter in the Modify Letters window, you now have the option to open the selected letter in Word. If any changes to the format of the letter are needed, simply click on the Open Form button to have Word open the associated letter mail merge for editing.

[Back to Top]

Because of the flexibility in the EBPP service from EBS, you can elect to

have the school pay the service fee for tuition but have the borrower pay

the fee for loans.

We will begin opening up this service on a school-by-school basis as soon as

soon as we receive your decision on payment of the service fee. On June 17,

we will begin offering this service to everyone. Unless told otherwise, we

will assume that the payer (borrower or student) will pay the service fee.

Please forward your decision to admin@ecsi.net as soon as possible. We are

excited to be able to offer this new payment vehicle and look forward to

providing an additional level of service to your students and borrowers.