Two new Special Codes (MD) and (NY)

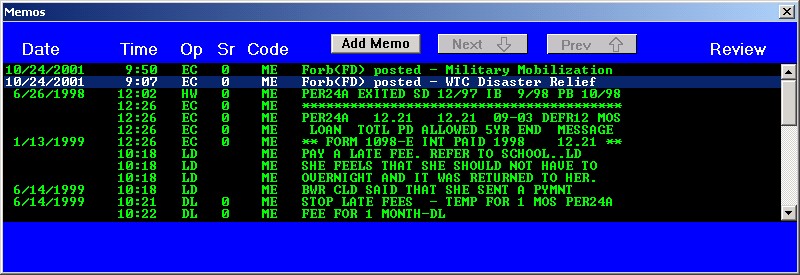

ECSI has added 2 new special codes due to the recent tragedies on 9-11-2001. The new codes are (MD), military mobilization and (NY), WTC Disaster Relief. Whenever a forbearance (FD) is processed on an account that has one of these 2 special codes, a memo will be written automatically stating that a forbearance has been processed along with the special code description.The Sal system will now automatically load a City and State when a zip code is entered from the Name/Address and Advance windows.

Also, when viewing the forbearance in the History Window, the user will be able to see the special code description that was associated with the forbearance at the time of the forbearance being processed. If no (MD) or (NY) special codes were on an account at the time that a forbearance (FD) was processed, then the area will be left blank.

ACH

ECSI has made dramatic changes to our ACH process. The changes have been in the making for months and we feel this provides the most flexible ACH process in our industry.

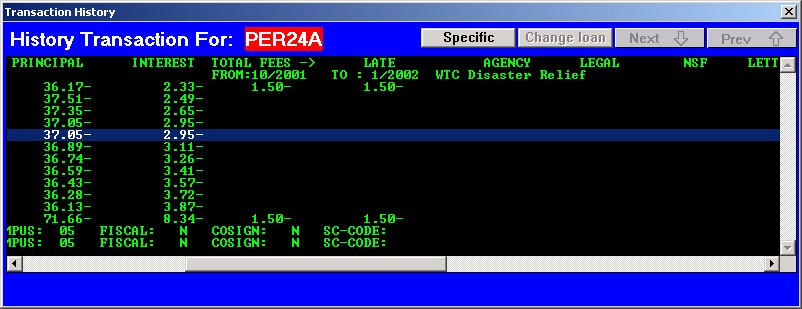

The first noticeable change is the “Changing Demographic Data” window after clicking on the “Name” button from the Primary window. The old window (Illustration 1) displayed only 1 field for ACH draw amount, ABA number, checking account number, etc.

Illustration 1

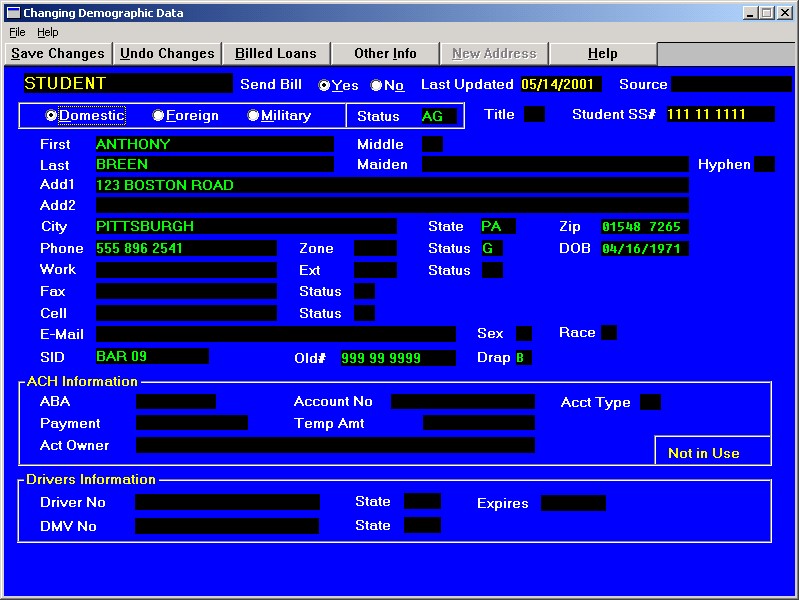

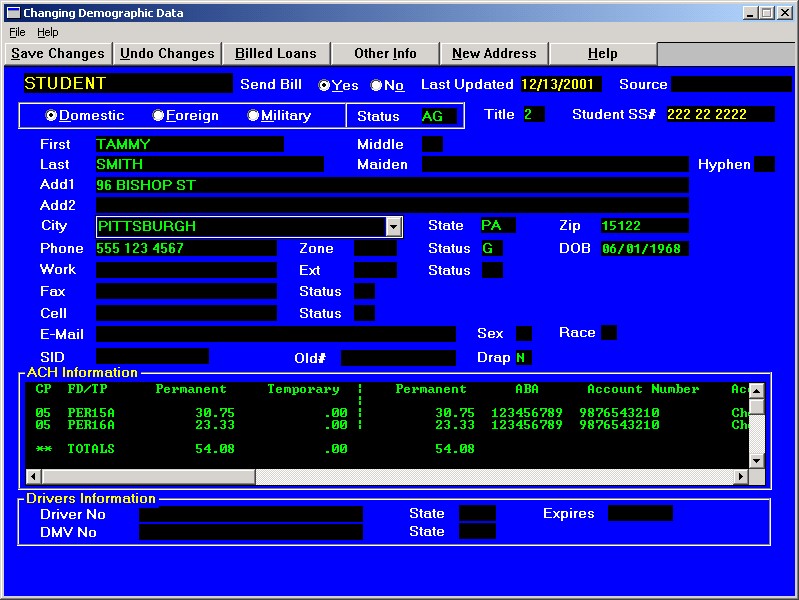

The new window (Illustration 2) has an “ACH information” selection box. The “ACH information” area will display all debts that are/were using ACH. The user can view all permanent and temporary ACH information from this selection box. To add or change ACH information, double click anywhere inside the “ACH information” area or single click on the “Billed Loans” button.

Illustration 2

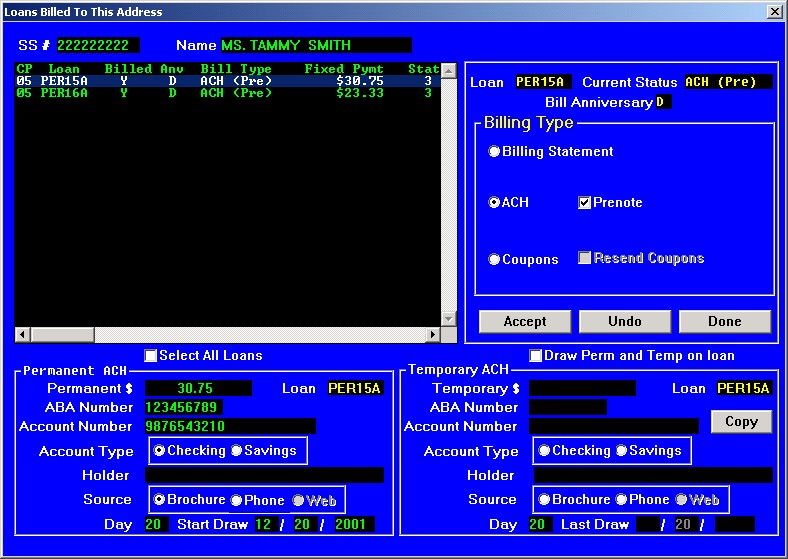

The top section of the “Billing Information” window has not changed. The entire bottom section of this window (Illustration 3) has been added.

Illustration 3

Listed below are the new fields along with a brief description.

Permanent

- $ - Dollar amount to draw

- ABA Number – Borrower’s ABA number

- Account Number – Borrower’s account number

- Account Type – Checking or Savings

- Holder – Account Holder’s name

- Source – ACH information was obtained from a brochure, over the phone or via the web

- Day – Draw day, either the 1st, 10th or 20th

- Start Draw – Start drawing the permanent dollar amount on and after this date

Note: The start draw day will be the same day as the selected “Day”.

Temporary

- $ - Dollar amount to draw

- ABA Number – Borrower’s ABA number

- Account Number – Borrower’s account number

- Account Type – Checking or Savings

- Holder – Account Holder’s name

- Source – ACH information was obtained from a brochure, over the phone or via the web

- Day – Draw day, either the 1st, 10th or 20th

- Last Draw – End date for temporary process

- Draw Perm and Temp on loan – Draw both permanent and temporary ACH dollar amounts if check box is selected and permanent start draw and temporary last draw dates are valid.

- Copy – Copy the permanent ACH information into the temporary ACH information.

To enter the ACH information:

- Either double click on a loan/debt or click the “Select All Loans” check box.

- Click on the “ACH” radio button (enables both permanent and temporary ACH areas).

- Enter the ACH information.

- Click “Accept”. (You will need to click “Accept” after each loan is updated).

- Click “Done”.

- Click “Save Changes” to save the ACH information.

Here are some special features and different scenarios on the new ACH process.

- Paid in full accounts will not display on the “Loans Billed to this Address” window. There is no need to change the billing status of a paid in full account.

- “Select All Loans” check box – Scenario: Borrower has 2 loans with a $30 fixed payment on their first loan and a $40 fixed payment on their second loan. After the user clicks on the “Select All Loans” check box and the “ACH” radio button, $70 (the total of the fixed payments) will automatically be placed in the Permanent $ field. Plan “2” accounts will include the fixed payment plus the monthly interest amount that is currently due. The user can override the ACH draw amount. In this example, the borrower wants the ACH draw amount to be $140, so the user will enter $140 in the permanent $ field. After the user finishes entering the ACH information and clicking on the “Accept” button, the $140 will be prorated over the 2 loans based on their fixed payment amounts. The program will place $60 as the ACH draw amount on the first loan and $80 for the second loan. The user once again has the flexibility to override these amounts by double clicking on any debt and changing the permanent $ field amount.

- The permanent start draw date can be months into the future. Example: The date today is 12-1-2001. A borrower calls and wants to be on ACH but doesn't want to start until 3-1-2002. The date of 3-1-2002 should be entered into the permanent start draw date field. Nothing will be drawn on this account until 3-1-2002.

- If the debt is in grace status then the program will default the permanent start draw date to the month before the principal begin date starts. The user can override this date and enter a valid date that will allow ACH to start drawing right away.

- “Draw Perm and Temp on loan” check box. If the “Draw Perm and Temp on loan” check box is not checked off and the temporary ACH is valid, only the temporary ACH dollar amount will be drawn. This check box has 3 different options when checked off. Use the draw date of 12-1-2001 for the example.

- Permanent ACH amount to draw is $50. The permanent start draw date is 11-1-2001. Temporary ACH amount to draw is $25. The temporary last draw date is 10-1-2001. The program will draw $50 on the account, the permanent ACH is valid and the temporary ACH is not valid.

- Permanent ACH amount to draw is $50. The permanent start draw date is 11-1-2001. Temporary ACH amount to draw is $25. The temporary last draw date is 6-1-2002. The program will draw $75 on the account, the permanent ACH is valid and the temporary ACH is valid.

- Permanent ACH amount to draw is $50. The permanent start draw date is 3-1-2002. Temporary ACH amount to draw is $25. The temporary last draw date is 6-1-2002. The program will draw $25 on the account, the permanent ACH is not valid yet and the temporary ACH is valid.

- The system has the flexibility of allowing a mother/father to both use ACH for one child. One parent would be set-up in the permanent ACH area and the other parent would be set-up in the temporary ACH area. In this scenario the mother and father can have different ABA and checking account numbers and every month ACH monies can be drawn from their separate accounts.

- ACH dollars will be drawn on all ACH coded accounts:

- (F) - First time ACH accounts, not pre-noted

- (N) - Pre-noted ACH account

- (A) - ACH account

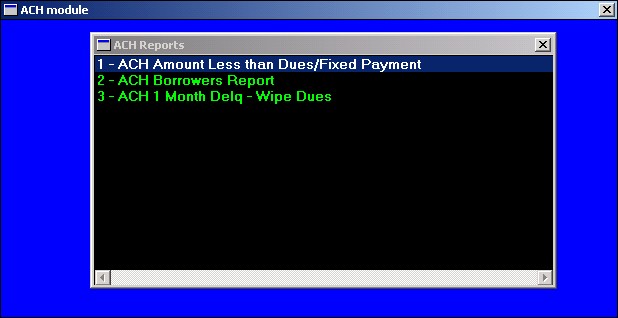

ACH Reports Menu (Illustration 4)

In the ACH reports area, there are 2 reporting options and a program that will automatically wipe out dues.

Illustration 4

- ACH Amount Less than Dues/Fixed Payment

This report will list all borrowers who have an ACH dollar amount less than their fixed payments and/or who have an ACH dollar amount less than their current dues.

- ACH Borrowers Report

Lists all ACH type (F, N or A) borrowers and their ACH information. The report will also notify the user if the borrower’s last ACH draw will pay them in full.

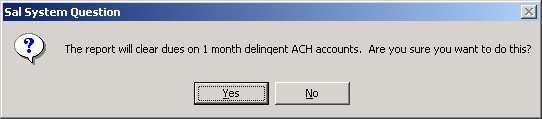

- ACH 1 Month Delq – Wipe Dues

This option will wipe all dues except interest on all ACH accounts that are 1 month delinquent. This will prevent these borrowers from receiving a delinquent billing notice. The user will be prompted with the message in Illustration 5 before processing begins.

Illustration 5

[Back to Top]

If the warnings are on 2 different social security numbers not associated with each other then the ACH numbers should be removed from both accounts until both accounts can be further investigated as to which numbers are correct. If both accounts are fine and you do not want them to show up on the out of balance report everyday then you can set the “ACH Dup OK” field (Illustration 2) on the Changing Demographic Data window to “Y”.

Web Site Updates

More on Exits

In the last newsletter, we introduced our new WebExit feature. WebExits enable borrowers to complete and electronically sign an exit interview using ECSI's web site. We have already released the next version to add even more functionality.

In addition to Perkins, the WebExit module can now handle Stafford and Direct Loans. Each of the loan types has its own narrative and set of questions, specific to the loan. The rights and responsibilities also are loan-specific.

When no dollars are provided for Direct or Stafford loans, no amortization schedule is presented.

San Diego State University (SDSU) was instrumental in assisting us to get the new Stafford and Direct modules working. In the first week of production, well over 100 exit interviews were completed on our web site, reducing the workload at SDSU.

We have received many questions asking what is required to enable your borrowers to complete an electronic exit interview. I've outlined the major steps below.

- The process usually starts with the registration and graduation matches in SAL. These modules prepare a list of people eligible to exit.

- ECSI will send a letter to each eligible borrower informing them that they must complete an exit interview. This letter will include the login information needed to access our web site. This letter can be customized by each client so that it has your own, personal touch.

- Each exit interview prepared by ECSI is loaded onto our web site. Exits prepared by the client are not loaded to the site.

- Based on our existing agreement with each client, questions about the loans we service can be answered by ECSI. All Stafford and Direct questions are forwarded to the client for processing.

- Every night, the exit interviews that were completed are processed. A memo is placed in SAL, the exit code is updated to "W" (WebExit complete) and any demographic information is loaded into the Name and Address section.

Along with this release of the WebExit module, we have finalized our pricing structure. The cost for each letter is the standard $1.00 fee. The cost of each exit interview completed on-line is $0.50.

The WebExit module appears to be a huge success so far and we're excited that so many of you have expressed an interest in using this service. We look forward to making future improvements in the service to increase its value.