ACH Information from Website

There are two methods for a borrower to have monies withdrawn electronically

from their bank account. ACH is based on a paper form that the borrower

sends to the school or to ECSI. Direct Payments are electronic payments that

the borrower makes directly on ECSI's web site.

ECSI merges the Direct Payments from the web site into SAL on a nightly

basis. As Direct Payments ultimately are processed as ACH transactions, we

previously did not identify them differently, which has caused some

confusion.

A change was made to the Demographics Window. When a borrower requests a

Direct Payment from our web site, the following message is displayed in the

ACH Information area "ACH Info from ECSI Website".

This new message will allow you to differentiate between a borrower who

submitted a 'traditional' ACH application and a borrower who requested

direct payments on the web.

[Back to Top]

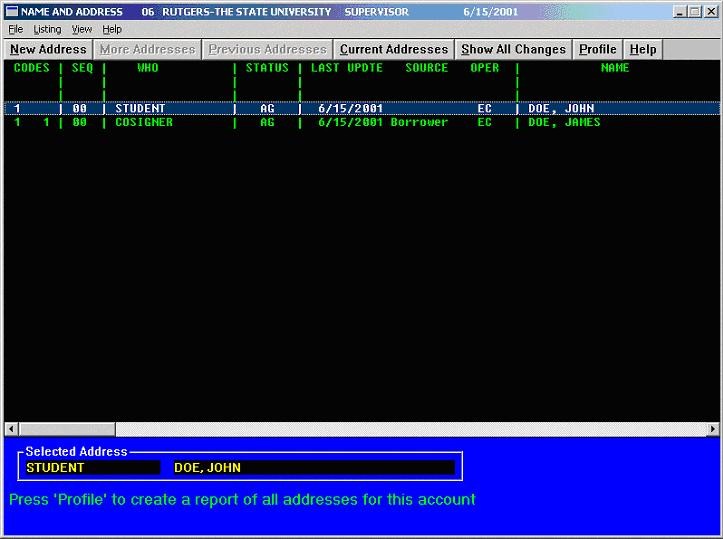

Address Profile Window

There is a new function on the Name/Address Listing window to create a profile of all addresses on the account. Click on the ‘Profile’ button to create this report.

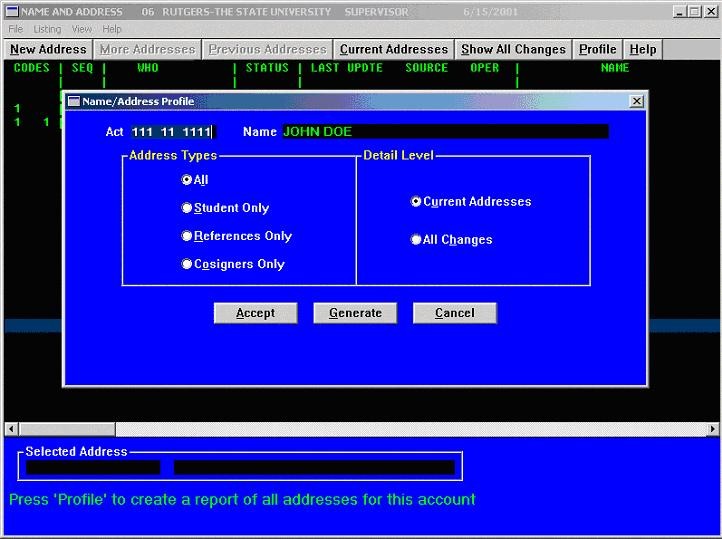

To create an address profile on an account, enter the account number (system will automatically load in the account that is currently on the screen), and then select the level of detail that you want to show on the profile. The options are:

Address Types:

- All – Creates a profile of all addresses on the account

- Student Only - Creates a profile of only the student addresses

- Reference Only - Creates a profile of only the reference addresses

- Cosigners Only - Creates a profile of only the cosigner addresses

Detail Level:

- Current Addresses – profile will only show current address records, not any changes

- All Changes – profile will list the current address and also all changes

Click on the ‘Accept’ once all options are set. The cursor will return to the account number field to enter any additional accounts.

Click on the ‘Generate’ button to display the Create/Look/Print menu. ‘Create’ will produce the actual profiles, ‘Look’ will allow you to view the created forms in notepad, and the ‘Print’ buttons will spool this report to the printer.

A shortcut to this window has also been placed on the ‘Forms’ area of the Primary Window.

Government Report on Student Credit-Card Debt Spurs Calls for Tighter Rules

A new Congressional report on credit-card use among college

students is prompting several lawmakers to call for tighter

restrictions on the marketing practices for the cards. But

some officials in the banking industry, arguing that most

students use credit cards responsibly, say the legislation is

unnecessary.

The General Accounting Office, which surveyed 100 officials at

12 colleges, reported few, if any, findings that surprised

officials on either side of the debate over college students'

vulnerability to credit-card debt. The report, which does not

make any recommendations, says that "Consistent misuse of

credit cards by college students, particularly combined with

student-loan debt, could lead to substantial debt burdens

[which] could become particularly severe after graduation,

when many students must begin making payments on education

loans."

About half of college students graduate with an average of

$19,400 in student loans, according to the report. Previous

studies show that roughly 60 percent of students pay off their

credit-card balances each month. Students who carry balances

month to month have an average balance of $577, according to

the report.

Many lawmakers say that credit-card companies prey on the

financial inexperience of young people. Although the report

neither proved nor disproved those assertions, it did note

that officials and students at several of the institutions

surveyed said that on-campus credit-card vendors did not tell

applicants about the consequences of misusing credit cards,

such as getting a bad credit record.

In a statement released this week, Rep. Louise M. Slaughter, a

New York Democrat and one of the three members of the House of

Representatives who requested the study, said, "Banks and

credit-card companies have put profits first without concern

for the customers' long-term financial interests."

Ms. Slaughter is a cosponsor of a bill that would limit credit

to 20 percent of a student's annual income without a cosigner

and that would require parents who cosign to agree in writing

to increases in credit limits.

But Joe D. Belew, president of the Consumer Bankers

Association, which represents banks and credit-card issuers,

said the report presents no evidence to justify federal

restrictions.

"We've got a long way to go in terms of improving the

financial literacy of young people," Mr. Belew said. "But the

fact is that most students are using credit cards responsibly.

There is always room for abuse, but at the end of the day,

debt is an individual's responsibility."

Web Site Updates

For the last three years, ECSI has made an effort to update our site on a

regular basis. As we head into our fourth year, we have redoubled our

efforts to make sure that the site is as up-to-date as possible.

In February, we started two new sections: Legislation and Headlines. Twice a

week, ECSI reviews dozens of web sites and gathers any pertinent

information. Headlines contain items that are of interest to our clients,

either academically or as they pertain to current trends. Legislation gives

you a summary of the items in congress that could affect you or your

borrowers.

Keeping to our promise at the 2001 User Conference, we have been documenting

major changes in the SAL software and placing them on our web site. Since

June, there have been twelve new documents placed in the SAL for Windows

Changes section. The SAL for Windows Changes is part of the SAL HelpDesk,

available on the Client page.

In the SAL HelpDesk section, you will also find a complete copy of the

on-line help manual. Clients may only receive a new copy of the on-line help

manual once or twice a month, depending on when your site receives a program

update. The version on the web site is updated approximately weekly.

Coming Soon!

Because of the changes in the last six to eight months, ECSI is finally in a

position to perform some additional 'site redesign'. Borrowers, clients and

agencies now have their own 'portal' page which logically separates the

sections of our site.

The current design has remained fairly static since 1998. Up until now,

we were much more concerned with getting information disseminated than

making the site 'pretty'. All that's about to change! ECSI sought the

assistance of a local design firm to suggest some changes to our site that

would make it more visually appealing but still retain the ability to be

accessed from a wide range of browsers.

Many of the changes will be cosmetic. The pages will have a softer

background than bright white. The navigation will be more customized to each

type of user (client, agency, borrower).

What will not change is the breadth of content that we have offered.

Everyone is committed to ensure that we don't lose a single document or

feature! Hopefully, by the next newsletter you will be able to see some of

the changes.

Process Rehabilitation

Post Rehabilitation

Starting from the Primary Window

- Enter the Social Security

- Click on Coll

- Click on Rehab

- Click on Post Rehab

- Double click on the loan(s) (you must have a plus ( + ) sign at the end of the line for the loan you have chosen)

- Click on Continue

- Enter New Rehab Amount and press enter or tab

- Enter Yes first payment due MM/DD/YY or No change to MM/DD/YY

- Click on Process Rehabilitation

- Click on OK rehab information posted & letter finder was created (Sal System Message)

- Click on Quit

Print Rehabilitation

Starting from the Primary Window

- Click on Forms

- Click on Letters

- Click on Generate Letters

- Click on Yes to overlay the merge file

- Double click on the RH0 Rehab line this will bring up MS Word

- Click on Merge to a New Document

- Click on Print

- Click on X to close word

- Click on No to save changes

- Click on No to save changes

- Do not exit from the RH0 Rehab line until your letters have been printed

- Click on the X to close the window

- Click on Yes (has the mail merge process been completed on each of the letters?)

- Click on X or Esc

- Click on X or Esc

Rehabilitation

ECSI has provided it's clients with an automated solution to handle the requirements of the Perkins Loan Rehabilitation regulations that became effective July 1, 2000. A User has the capability to :

The system performs the following processing:

The system automatically tracks accounts that have been placed in a rehabilitation pending status. These accounts are placed at the top of the priority table when a payment is received and the rehabilitation amount is used to determine how much is applied to a loan. The records are analyzed prior to the billing calculation to determine whether consecutive payments are incremented if the agreed upon amount was paid or the account is removed from rehabilitation when a payment was missed. Furthermore, the User can identify the rehabilitation amount, end date and consecutive payments made when viewing the loan in the Primary Window.

Additional features that exist to assist borrowers and Users with their rehabilitation efforts are:

- A special message appears on the invoice statement which shows the total rehabilitation amount owed, the last payment date and consecutive made.

- The User may generate a report on-line to identify all rehabilitation accounts. The report is sorted alphabetically in highest consecutive payments made to lowest order.

- Our 60-day final demand letter includes the rehabilitation benefits on the back of the page.

- After 12 consecutive payments have been made the account is removed from rehabilitation pending status. All amounts due are removed at that time and a comment is generated to indicate rehabilitation was successfully completed. The loan record is also updated to indicate the account will be deleted from the credit bureau files the next time a credit bureau update is performed.