Inside this issue:

What's New: SAL Windows Update

ECSi's Website Services

ECSI 2000 Conference

1098-E

CD-ROM Reports

Y2k

Close Out Dates

National Student Loan Clearinghouse

Federal Perkins Loan Regulation Changes

The special code master file was created to establish descriptions/definitions for each special code. In the DOS system, end users would enter special codes on borrower's accounts and then the user would be reassigned to another position at the school. The new user coming in wouldn't have any idea what the special codes meant. On the Windows version there is a description associated with every special code.

The "setup special codes" button will allow the user to add, change or delete a special code from the master special code list. ECSI reserves 13 special codes for internal use, so every school has the ability to use 37 of their own special codes. ECSI's 13 reserved special codes cannot be changed or deleted. The change button will let the user change the description of the special code. The delete button will allow the user to delete the special code out of the master special code list and will also search all borrower's accounts and remove any special codes that match the code that was deleted.

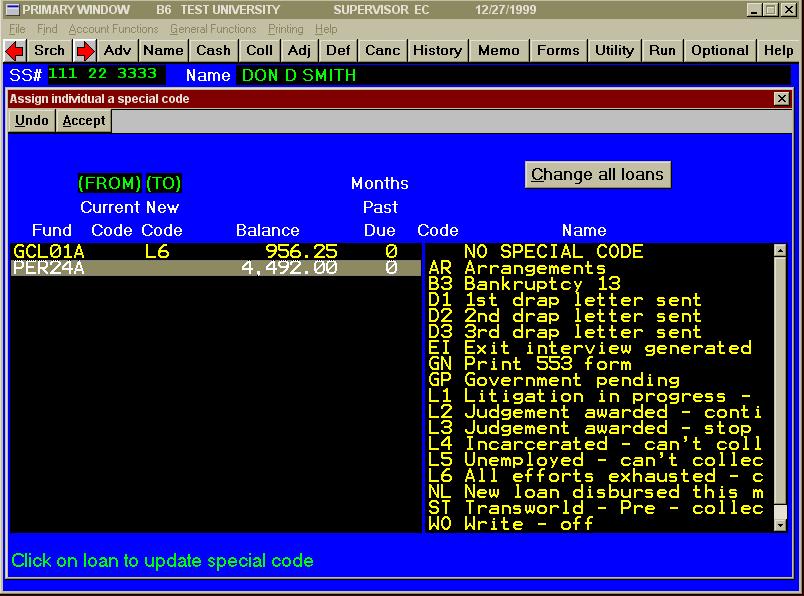

The "assign individual" button (displayed on page 1) allows the user to assign one, some or all loans to a particular special code. The left side of the window will display the fund type, current special code, new special code, loan balance and months past due for all loans. The right side of the window will display all of the available special codes (with descriptions) that the user may assign to any loan(s). To add or change a special code on a borrower's account, click on the fund type that you wish to change. Then click on the special code that you want applied to the chosen fund type. Before you have saved your changes (clicking on the accept button), if you decide you don't want to accept the changes, either click on the "X" button or the undo button. Change all loans button will allow the user to change all of the loans for a borrower to a particular special code, with 1 click. If a borrower had 5 loans, the user could click on all 5 loans and then click 5 more additional times on the special code that you want to apply. This way the user can click on the "change all loans" button 1 time and then click on the appropriate special code only 1 time also. This is a much more efficient way to handle multiple loans.

The "mass change - reassign special codes" button allows one type of special code, for all borrowers to be changed to a different type of special code. Example, all borrower's loans special coded "L1" change to "L2". The program will then check every borrower's account to make the necessary special code change.

The collector code windows are identical to the special code windows. They both have the same 3 functions: setup button, assign individual account and mass code changes. The only additional button that the collector code window has that the special code window doesn't is the collector history button. The collector history button will show the user the entire history of when collector codes were changed and what were the codes changed from and to.

Before breaking new ground, I'd like to say that I was glad to see so many people sign up for the Web update notification. So to the many people who signed up, we hope you find the updates to be a useful addition to our Web site. If you have not signed up yet, you can find the Update Notifications on the Client page, under Client Application.

Its that time of year when the regulations have been released. You will find information in another part of this newsletter. Of course the web site was updated in November to alert you to the changes. Each regulation announcement links to the full text of the amendments in the Federal Register.

Starting in August 1998, ECSI provided the facility for borrowers to check the status of their student loan accounts using their web browser. Since May of 1999 we have been tracking in detail the number of borrowers accessing their account information using ECSI's web site.

During the first few months, we were excited when forty borrowers used the Account Information page in a week. Now, on an average day there are usually fifty borrowers checking their accounts. Weekends and holidays are especially popular, with over 300 borrowers accessing the site some days. All totaled, since May there have been over 6,000 borrowers accessing their information a total of 26,000 times. That means each person comes back on average four times.

One of the most frequent suggestions is to present full account history, similar to the account profile. Another suggestion was to place a link on the account information page directly back to the school's site. We are considering these enhancements for the first part of 2000. If you think something would be valuable to your borrowers, please let us know. We are always open to suggestions to make the site better.

Any suggestions for the borrower's section or any other part of the ECSI web site can be sent to Webmaster@ecsi.net.

Several of our forms have been added to the Borrower's section of the site. Previously, the major attraction to this area was borrowers could check their student loan account information. Now, they can access Deferment, Cancellation and Forbearance forms and the entire ACH brochure including the application. We also provide a link to the IRS form W9S for correction of Social Security Numbers. These forms were prepared for use with Adobe's Acrobat reader. Acrobat enables anyone to print exact duplicates of the forms that would normally be mailed out. For borrowers without the required Acrobat reader, we provide a convenient link to Adobe's registration page.

We've gone one step farther with our forms. If the borrower has a recent version of the Acrobat software, they can actually complete the forms on-line prior to printing. This makes the returned forms easier to read and process.

On-line forms save time and money and we hope that you will inform your borrowers that these forms are now available electronically.

Start making your plans to attend the 2000 ECSI User's Group conference. We will hold our annual conference here in Pittsburgh at the Sheraton Station Square. The dates are April 10, 11 and 12.

We are working on the conference materials and will be posting information on our web site as it becomes available. Starting in January, look in the Client Section for all the details. We are thinking of doing a pre-conference survey so if you think you might attend, please watch the web site and give us your opinions. This conference is intended for you and we want your input.

Tis the season to begin preparing tax documents. ECSI will again provide the same services we offered for tax year 1998. Our rates have not changed but we will be adding one additional service. This year borrowers will have the ability to review their 1098-E as part of their account information. The information will be available on our web site the day the forms are prepared.

Last year's contract remains the same. The original contract will be perpetual until changes are required. If your institution requires a new contract, just contact us by phone or by email (Admin@ecsi.net and a new contract will be sent.

Any client wishing to file 1098-T's with ECSI is urged to contact John Lynch (jlynch@ecsi.net as soon as possible to ensure the proper arrangements are in place.

We briefly spoke in the last issue about providing reports on CD-ROM. So far the responses to CD-Reports has been very positive. In November we announced (on our web site) that all clients receiving Micro-fiche will be converted to the new CD-Reports.

Several clients have asked if they will be converted from diskettes to CD-Reports. Our intention is to begin an orderly conversion starting in January. We anticipate that all clients will be converted prior to the Users' Conference in April. If you have a special need and cannot wait, please let us know. We will try to accommodate your needs.

We've discussed that the DOS version of SAL has no known Y2k glitches and therefore should perform normally before, on and after January 1, 2000. Of course if you are one of the schools already converted to SAL for Windows, you have nothing to worry about either. Our Windows product was written from the ground-up to be Y2k compliant.

Are you out of the woods yet? In order for SAL to work properly, your PC hardware and operating system must pass the Y2k test. Also, if you use SAL data in any other application (such as Excel or Lotus), you will need to ensure that those applications are compliant also.

Typically you should consult your technical staff for assistance. But, if you are just curious or have to resolve this issue yourself, take a look at the ECSI web site. In the news section you will find some background on this topic. In the Links section you will find many Y2k resources. There are links to educational resources explaining the problem, utilities that can check your hardware and places where you can verify your version of popular software packages passes the test.

| Jan | Feb | Mar | |

| Mid-month Billing Calc | 12 | 14 | 13 |

| End-month Billing Calc | 31 | 29 | 31 |

| Final Transmission date for reports | 30 | 28 | 30 |

| Reports mailed to schools | 1/2 | 2/2 | 3/2 |

Beginning October 1999, ECSI started processing student deferments without borrower signatures. The interface between ECSI and NSLC works as follows:

ECSI sends a file of all borrowers in grace and repayment to NSLC. NSLC then compares their database (which consists of 90% of all schools in the U.S.) Against the ECSI database, anyone registered at another school will be added to an interface file which will be transmitted back to ECSI. Previously, ECSI sent a letter to each borrower, stating where the student is now attending, what their current status is (full-time, half-time, leave of absence), when they are expected to graduate and reminded them they are eligible for a deferment if they sign and return this letter to ECSI.

With the new regulation changes, we are able to automatically process all deferments without signatures. Our system checks for continuity from previously applied deferments and extends the deferment range up to 12 additional months. Each borrower receives an audit statement, showing the new deferment date range. We will also create a collection memo0 starting which school they attend, their status and expected graduation date. If the status of the borrower changes, NSLC notifies ECSI immediately. Any borrower that withdrawals from school or falls below "half-time status" will be changed, automatically, to repayment status. ECSI will also create and provide each school with a report, in detail, showing who was effected by this interface. ECSI anticipates a tremendous time savings in processing deferments and a significant reduction in delinquency. The NSLC performed an analysis and found, 10 - 20% of all borrowers eligible for deferments never filed the proper paperwork.

An institution may establish the following repayment incentives:

Limitation on the use of funds:

Each institution must establish a loan rehabilitation program for all borrowers for the purpose of rehabilitating defaulted loans made under this part. The institution's loan rehabilitation program must provide that:

Within 30 days of receiving the borrower's last on-time, consecutive, monthly payment, the institution must:

Collection costs on a rehabilitated loan:

After rehabilitating a defaulted loan and returning to regular repayment status, the borrower regains the balance of the benefits and privileges of the promissory note as applied prior to the borrower's default on the loan. Nothing in this paragraph prohibits an institution from offering the borrower flexible repayment options following the borrower's return to regular repayment status on a rehabilitated loan.

The borrower may rehabilitate a defaulted loan only one time.